Government says oil exports disrupted due to blockade on Red Sea

The government on Tuesday said it is struggling to export crude oil to international markets, due to blockade imposed on the Red Sea by Houthi militants who have since January been attacking cargo ships.

Michael Makuei Lueth, the minister of information, communication, technology and postal services, said that cargo ships carrying crude oil shipments from Port Sudan are wary of the insecurity on the Red Sea, despite the current reduction in oil production levels in the northern oil fields due to flooding and the jelling within station 4 and 5 of the oil pipeline.

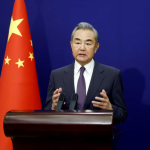

“The war in the sisterly neighbor, Sudan has greatly impacted on the economic situation in South Sudan, which relies mainly on oil production. The oil wells that were water-logged by heavy floods over the past rainy seasons are still unrecovered and the oil sector has not been able to increase production. Now, the pipeline taking crude to Port Sudan has experienced jelling process in stations 4 and 5, making it difficult for the crude oil to reach export market,” Makuei said during press conference held in Juba.

“Even if the crude were to reach Port Sudan, it would still not be possible to ship it for sale due to the threat of blockade of shipping in the Red Sea. So, apart from low production, there are physical difficulties confronting the oil sector. Unfortunately the non-oil revenue sector is mainly, inter alia, dependent on imported goods,” he disclosed.

South Sudan since November 2023 till January 2024 had been exporting about 150,000 barrels a day of crude oil to international markets.

The latest development comes as the economy is struggling amid high inflation that has resulted in the continuous depreciation of the South Sudanese Pound against the U.S dollar.

The dollar is currently exchanging with the South Sudan Pound at 1,500 SSP from the previous 1000 in December 2023.

“The government is fully aware of the suffering of it’s citizens as a result of the financial crisis in the country as outlined above. The cost of goods has skyrocketed, especially fuel and electricity. Although the dollar exchange rate is very high in the region and elsewhere, South Sudan had controlled it at 1000 South Sudanese Pounds to the dollar until recently,” Makuei said.

He added that the current financial crisis largely originates from poor fiscal performance due to lack of revenue diversification and dependence on oil proceeds, adding that the National Revenue Authority is fragile, vulnerable and unable to increase tax proceeds.

“The combination of all these factors has seriously affected our resource envelop,” Makuei said.

Makuei disclosed that the government is taking proactive measures to mobilize resources through streamlining collections, consolidating government finances, implementing public finance management (PFM) reforms and diversifying the economy.

He said that this approach will enable the government to meet it’s obligations including clearing salary arrears and funding the upcoming general elections in December 2024.

Makuei also noted that the central bank is strengthening it’s monetary policy framework and mobilizing foreign exchange in order to stabilize the market.

“These measures include, maintaining restrictive monetary policy, revisiting the deployment of monetary policy instruments and rebuilding foreign exchange reserves and coordinating with the fiscal authorities to tighten fiscal policy, while mobilizing domestic revenue and modernizing payment systems which addresses the issue of excess liquidity outside the banking system and supports electronic banking and other mobile platforms to foster financial inclusion,” he said.