Expert calls for equitable share of hard currency to banks, forex

The Bank of South Sudan (BOSS) has been advised to allocate hard currency equitably to all commercial banks and forex bureau in order to meet high demand for forex exchange.

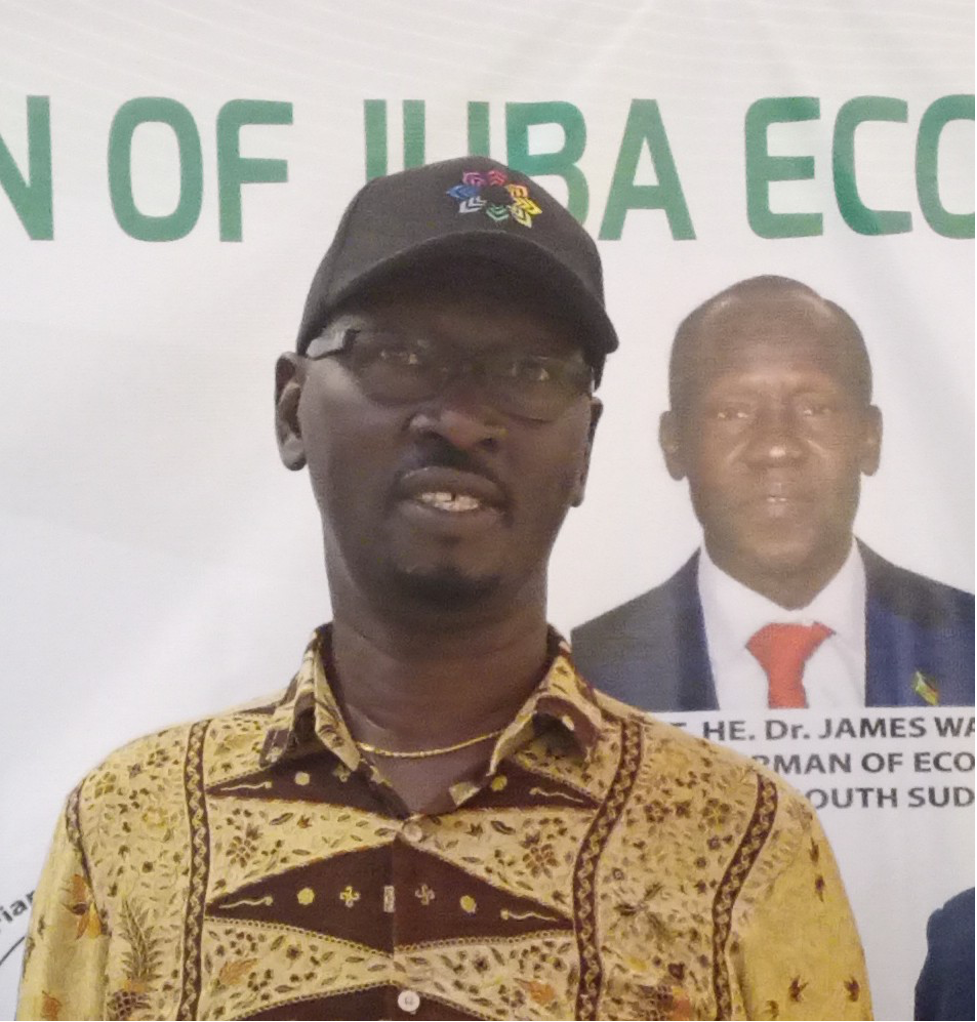

This was revealed by Abraham Maliet Mamer, the economic advisor for the economic cluster led by Vice President James Wani Igga on Saturday during the closing of the Juba economic forum at Pyramid Hotel in Juba.

“I am appealing and it is going to be a political decision, we have 41 banks give every bank 100,000 U.S dollars and let them sell it, I am sure you will see something (exchange rate) dropping down,” Mamer told journalists.

“For us to control dollars we must go back and reintroduce actual letter of credit, we should also introduce credit card, when we travel we carry too much cash, what for? We have to go digital,” he added.

Thomas Muto, the patron for Central Equatoria Business Union, said the Juba economic forum will benefit the country and the region in wealth creation.

“The Juba economic forum is going to generate ideas from experts from different walks of life, and it will contribute to economic development and as well wealth creation not only to Central Equatoria State but to this country as a whole,” he said.

Emmanuel Adil Antony, the Governor for Central Equatoria State, said that strengthening the economy requires public- private partnership in investments.

“What is required is public- private partnership, there are so many commitments and that is where public and private sector meet and collaborate to strengthen the economy for the sake of the country,” he said.

The South Sudan Pound has of recent depreciated against the U.S dollar exchanging currently at 80 SSP from the previous 62 in June last year.

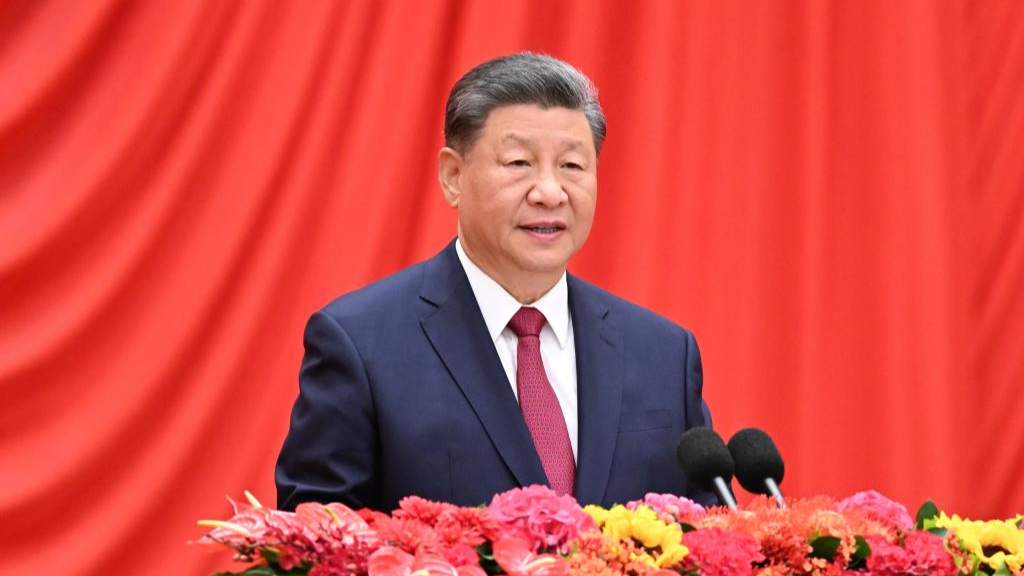

Experts have blamed the depreciation of the pound on lack of production and the war in Ukraine which has cut off supply of food, fertilizers and also disrupted the global oil market.